What Is Buy Now, Pay Later? What Stores Offer It?

Important Note: When you buy through our links, we may earn a commission. As an Amazon Associate we earn from qualifying purchases. Content, pricing, offers and availability are subject to change at any time - more info.

Key Takeaways

- Many shops, apps, and websites allow you to use a buy now pay later feature.

- Some apps allow you to create an account and buy products from different stores, while others will enable you to buy from the app itself.

- Buy now, pay later is a small financial plan that allows you to buy a product, usually with a small down payment, and then pay off the rest.

- Buy now, pay later apps and businesses usually do not affect your credit score by making a purchase. However, not making a payment will still negatively impact your credit score by weakening it.

When looking at the name, buy now, pay later, it seems like a very convenient way to get what you want without waiting and saving up for months to afford it. However, as we know from other instances, names can be pretty misleading. So, what precisely is buy now, pay later? And maybe more importantly, what are the risks, and which apps or stores allow you to do so?

Advertisement

Where To Buy Now, Pay Later

Whether you are buying a replacement computer or want to get the newest console you’ve been wanting, plenty of places allow you to use a buy now, pay later option.

These shops, apps, or websites usually do not charge you extra to use this option, and there is usually no added interest to the repayment. If a specific shop does not offer you this option, there is a chance that you might be able to get a different app or website to help you buy through them.

Walmart

- Sign-up Required: Yes

- Credit Check: Eligibility Check

- Can Be Used In Store: Yes

- Can Be Used Online: Yes

- Payment Terms: 3 to 24 months (regulated by Affirm)

Walmart is one of America’s most well-known and influential store brands that allows you to use a buy now, pay later system. Walmart has over 10,500 stores worldwide and operates online with an e-commerce storefront.

Walmart has a selection of items and categories that qualify for buy now, pay later services with selected users. To use this payment option in a store, you will first have to register online through Affirm and then scan your single-use code at the register.

Advertisement

For online sales, you must also complete the sign-up form and will then be allowed to select the Affirm payment method in the checkout process.

The repayment for this service can last between 3 and 24 months. The repayment term will be set based on the total amount of the purchase and your choice in the number of payments. Once the purchase is successful, you will need to schedule repayment terms on the Affirm app.

Amazon

- Sign-up Required: Yes

- Credit Check: No (Review of your Amazon record)

- Can Be Used In Store: No

- Can Be Used Online: Yes

- Payment Terms: Unspecified

Amazon is the world’s biggest online marketplace selling anything from groceries to high-end technology. It comes as no surprise, especially when considering the cost of some products, that Amazon also has a buy now, pay later option.

Amazon calls its buy now, pay later plan “Monthly Payments,” and a select variety of products are available for purchase, through this means, to select persons. Your eligibility to use this payment agreement is calculated mainly by reviewing your Amazon record.

You are also not allowed to use the item you purchase for business as the agreement states that you agree the item is bought for personal use only. There are a couple of other things that you should take care of before using this service, as there are a couple of terms that Amazon can set.

If you want to learn more about how this payment option works, read about it on Amazon‘s website.

Advertisement

Urban Outfitters

- Sign-up Required: Yes

- Credit Check: No (Immediate approval decision)

- Can Be Used In Store: Yes

- Can Be Used Online: Yes

- Payment Terms: 4 payments, one every two weeks

Urban Outfitters is a “lifestyle” retail store known mainly for its sale of clothing items. This store is online and has select stores around the US, Europe, and Canada. Urban Outfitters uses a service called “Afterpay,” which is essentially the same as buy now, pay later.

You can buy almost anything Urban Outfitters offers using Afterpay, but you cannot use Afterpay to purchase gift cards.

You can use Afterpay in-store via the app or online at the checkout section. You can only use Afterpay for orders between 35 and 2000 USD, and you will need to pay back the total amount over four payments made in two-week intervals.

The Afterpay system is a short-term, interest-free repayment plan. However, additional fees may apply if you cannot afford or do not make payments when needed.

I should also note that Afterpay is not a service provided by Urban Outfitters only, and you can use this service over a variety of stores.

Read more about Afterpay on their website.

Sezzle

- Sign-up Required: Yes

- Credit Check: No (Immediate approval decision)

- Can Be Used In Store: No

- Can Be Used Online: Yes

- Payment Terms: 4 payments, over six weeks

Sezzle, though not a store, is an app that is partnered with several stores to allow you to buy now and pay later. On their website, you will find several stores they are partnered with, and you can also download the app from there.

Advertisement

After signing up with Sezzle, you will receive an immediate answer on whether or not you qualify to use their service, meaning that you do not have to wait for ages and get no further. Sezzle allows you to make a purchase and then pay back the total amount over four installments, starting on the day of your purchase.

When using Sezzle, there is no build-up of interest, and no additional fees need adding as long as you make your pay your installments. Sezzle is also proud to say that you can use their services at over 47 000 different online retailers, allowing you the freedom of buying where you please.

Learn more about Sezzle and what they offer on their website.

Affirm

- Sign-up Required: Yes

- Credit Check: Eligibility Check

- Can Be Used In Store: Yes

- Can Be Used Online: Yes

- Payment Terms: 6 weeks or 3 to 24 months

Though Walmart uses affirm, it is not a service owned by Walmart. Affirm, like Sezzle, is a stand-alone buy now, pay later service provider.

Affirm allows you to shop from multiple different stores, both online and at shops, and then allows you to pay back the total of your purchase in installments. However, what sets Affirm apart from others, is that it does not only not ask interest, you can also choose your payment plan.

Depending on the total amount of your purchase, and your own choice, you can choose to pay off your Affirm credit either by paying it over weekly installments or monthly installments.

Affirm is also against credit cards and prides itself on clean practices. Affirm is partnered with many stores, and they receive a commission from those stores. These partnerships allow them to be upfront and honest about what you need to pay. They claim that there are never any fees added to your account, and there will also be no additional interest if you do the fast repayment method.

Learn more about Affirm and sign-up on their website.

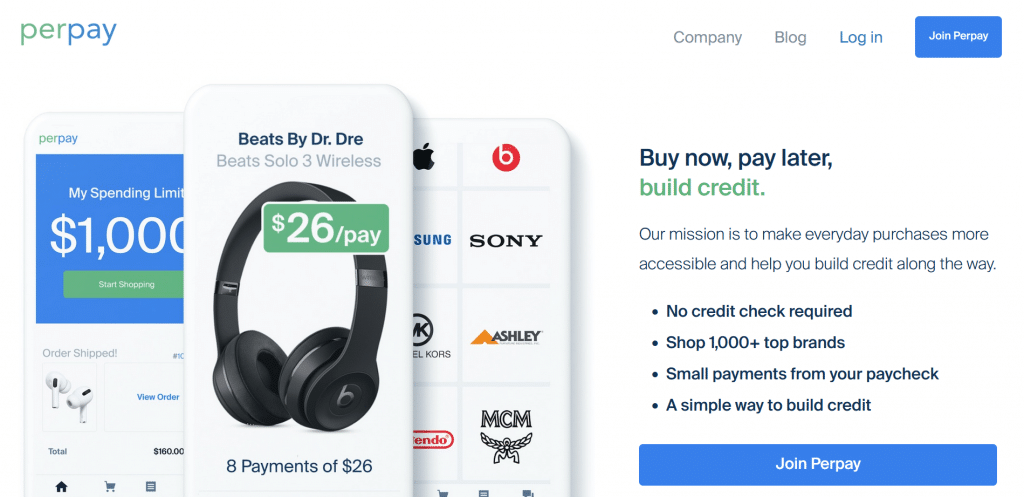

Perpay

- Sign-up Required: Yes

- Credit Check: No

- Can Be Used In Store: No

- Can Be Used Online: Yes

- Payment Terms: Not Stated

Perpay is another buy now, pay later service provider that allows you to make a purchase and pay it off over a selected time. Perpay uses a marketplace, accessible to you via their website or app, to show you what you can buy by using their services.

Advertisement

Perpay does not require you to pass a credit check and allows you instead to build up your credit with an average of 39 points. It does seem like there are additional fees charged with the use of this service, as it states that the more you use the service, the higher your limit becomes and the lower the repayment becomes.

If you are looking to use this service, read about the company and its policies before becoming a full-on member.

If you are curious about joining or learning more about Perpay, visit their website.

Related Questions

Though you know now where you might be able to use a buy now, pay later service, there are quite a couple more aspects to consider. Below are some related questions and answers to help you fully understand what this service is and some of the risks involved.

What Is Buy Now Pay Later?

Buy now, pay later services function on the concept that you can buy something that you do not have enough money for, and pay for this product later. This service can also be described as short-term financing and can be used instead of a credit card.

Buy Now, Pay Later Facilities — How Do They Work?

Though not all of these services are the same, and some may differ exponentially, buy now, pay later services are partnered with certain stores to allow you to purchase goods and pay them off. It is common for these services to have payment plans that start with a payment on the day of the purchase and then more payments every two weeks as agreed.

Usually, these services are not as strict as credit cards or loans. They also tend to be easier to qualify for, making them available to many who can’t afford typical loans or financing.

Does Buy Now, Pay Later Charge Fees Or Interest?

Most buy now and pay later services do not charge extra fees or interest. They do not need to charge interest or fees because the service providers usually come partnered with shops or brands that pay them a commission of all purchases made in this way.

However, some of these services charge both interest and additional fees, so be sure to read the terms and conditions carefully to avoid this.

What Are The Risks Of Buy Now, Pay Later?

There are a couple of different risks that you should know about before using any of these services. These risks aren’t accurate for all providers of this service, but it is always good to research the company beforehand.

Fees And Interest

Though most of the companies or shops that allow you to use this service are up-front about any fees you have to pay, by just doing some light reading, you’ll see plenty that isn’t. Some companies avoid specifying what costs are, and some companies include clauses into their terms of service that allow them to charge as much or more than some credit cards.

It is essential to read up on the company before using their service.

Returns Policy

Some of these companies work on a similar concept to other financing businesses, which means that you might have to keep paying for something you do not have. Whether your product was stolen, broken, or returned, some companies will still require you to finish paying your installments.

If you have bought something on credit or used the financing to pay for an item, you still have to pay the owed amount until that debt is paid in full. However, some shops and companies will scrap your outstanding balance if an item is taken in for return and the problem or damage was not your fault.

Negative Credit Score

Most buy now, pay later companies or shops, do a soft credit check to see if you are eligible for this service. Usually, this does not take any points from your credit score, though some companies do a proper credit check, which might dent your score.

At the same time, many of these services are on offer by companies saying that they will not affect your score, with the fine print being that this is only true for the prequalification check. Even if the company does not do a full credit check and lessen your score through that, any skipped or late payments could still significantly lower your credit score.

Can I Be Approved With A Bad Credit Score?

Yes, some shops or companies are trying to help you improve your life by allowing you to buy what you need even if you have a bad credit score. However, unless expressly stated on the website or app, you might have to sign up and see before you can know.

Please Support Me on Ko-fi

Please Support Me on Ko-fi